Checking in with Hospitality

The hotel industry has proved to be far more resilient than many had predicted when travel came to a screeching halt in 2020. Although the outlook is more positive than it was two years ago, developers and investors continue to see both challenges and opportunities ahead.

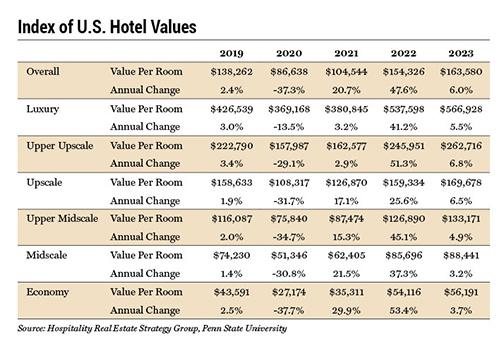

There is no sugarcoating the crash that hit the hotel market following the outbreak of the COVID-19 pandemic. The shutdown in travel was disastrous for owners, with a precipitous drop in revenue per available room (RevPAR) and property values. Frankly, many owners didn’t know when a recovery would come — or if they would be able to survive until it did. Although business travel and group demand have been slower to recover, the industry has seen dramatic improvement in fundamentals.

“We had predicted a longer recovery than what we experienced, but the market appears to be all the way back in terms of operations,” says Michael C. Lady, CCIM, MAI, FRICS, senior managing director in the Indianapolis office of Integra Realty Resources. Occupancies are now near pre-pandemic levels and average daily rate (ADR) is above 2019 levels, which are both contributing to stronger RevPAR. “As far as property values are concerned, we’re back to, if not exceeding 2019 levels,” he says.

According to STR, a division of CoStar Group that provides market data on the hotel industry, the trailing 12-month RevPAR through June shows that the U.S. hotel market is 100 percent back to where it was pre-pandemic. The country reported an all-time high RevPAR of $108.64, while occupancies of 70.1 percent were the highest since August 2019. “Rates remain very strong, and there is a lot of pricing power going on with hotels right now,” says Carter Wilson, senior vice president, consulting at STR. By the end of this year, STR is expecting RevPAR to be 30 percent higher year over year and about 10 percent higher as compared to the end of 2019.

However, that recovery has not been even across different geographies and segments of the hotel market. Some city center properties are still struggling, and group demand is only back to about 70 percent of pre-pandemic levels, according to STR. In addition, the recovery is less robust when accounting for inflation. In real terms, full recovery of ADR and RevPAR are not projected until 2024. “There is no doubt that inflation does strip away some of those gains,” says Wilson. However, real growth in average ADR exists with rates that will be up about 18 percent versus inflation at 9 percent, he notes.

Buying Opportunities for Investors

Prior to the Fed rate hikes in July, the recovery in occupancies and cash flows were driving a resurgence in property sales within certain segments of the market. MSCI Real Assets reported $44.5 billion in hotel sales in 2021, and the first half of 2022 has maintained a steady pace with $22.4 billion in transactions.

New Hampshire-based Wason Associates Hospitality Brokerage Group enjoyed its best year for hotel investment sales transactions in 2021 — and 2022 could match that level. The firm sold 16 properties with an average price around $8 million. Year to date through mid-August, the firm has 13 properties that are either sold or under purchase agreement. Part of that sales velocity is due to pent-up demand from buyers, notes Earle B. Wason, CCIM, president of Wason Associates. In particular, properties in destination locations are hot, which is a key segment Wason Associates serves throughout the northeast. “We were really in the right place at the right time,” he says.

Some investors have viewed the disruption in the market as an opportunity to acquire assets at a discount to 2019 prices and/or to gain a foothold in desirable markets.

The outlook for the second half of the year is more uncertain due to a shortage of inventory. The volume of for-sale hotel assets on the market dropped considerably in July and August as both buyers and sellers pushed pause in the wake of higher interest rates. The summer months are often slow in the transaction market. With the Fed raising interest rates another three-quarters of a point in September, deal volume could be somewhat low through the end of 2022.

In addition, the sales market has been bifurcated with properties that have recovered versus those segments of the market that have been lagging. For example, sale conditions for many urban hotels are still challenging. “A lot of owners aren’t going to list properties unless they have to, because they know they would be selling at a discount,” notes Wason. “At some point, those locations will come back, but the question is how soon.” In some cases, owners have given those properties back to the lender, particularly those financed with non-recourse CMBS loans.

In contrast, cap rates in some destination markets have held relatively steady with very strong pricing. For example, Wason has seen some destination hotels in Portland, Maine, generate prices of $300,000 and more per key. However, with recent interest rate increases, cap rates for anything in the works are going to have to be higher, he adds.

Few Vacancies in Distressed Assets

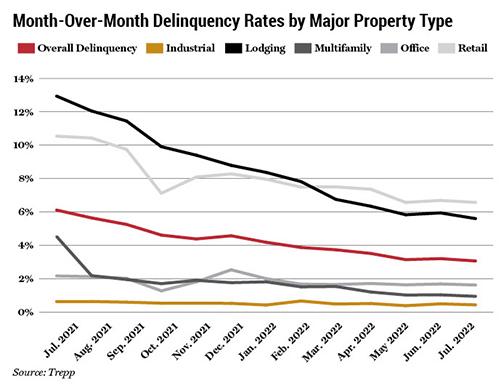

The pandemic did create a significant amount of distress across the hotel sector, but the surge of distressed buying opportunities that many had expected to see never materialized. “We were getting ready for a large wave of bankruptcies, but what we saw was that a lot of the banks and the CMBS special servicers reworked the debt,” says Daniel Marse, CCIM, commercial sales and leasing at NAI Latter & Blum in Baton Rouge, La. “I don’t think the banks wanted to take back the debt and have the liability associated with them,” he says. According to Trepp, CMBS lodging loans that were 30+ days delinquent dropped to 5.6 percent in July compared to 12.94 percent a year ago.

Some investors have viewed the disruption in the market as an opportunity to acquire assets at a discount to 2019 prices and/or to gain a foothold in desirable markets. For example, New Orleans is a high barrier-to-entry market with limited land availability, which makes it challenging to build new properties. “I think a lot of hotel investors are looking at the current market as an opportunity to buy,” says Marse. The New Orleans market saw RevPAR drop by 60 percent in 2020, and some industry experts are not predicting a full recovery in the Big Easy until 2024. However, several large institutional sales have been completed over the past 12 months, he says.

Values have held up better than people thought in certain markets. Data from the Green Street Commercial Property Price Index shows that lodging prices for July were up 8 percent year over year and up 1 percent compared to pre-pandemic pricing. Where values have eroded is in the urban and suburban locations that are more dependent on business travelers. In those cases, the current cash flow doesn’t warrant the cap rate that existed pre-pandemic. However, the market for destination hotels has remained very strong, with revenues in many cases above where they were pre-pandemic, notes Wason. “There is a lot of money chasing deals,” he says. “I’ve seen some resort portfolios sell for prices that I never dreamed would happen, but that’s because these buyers have cash that they need to put to work.”

Developers Find Room for Opportunity

It’s no surprise that the development pipeline has thinned, given some of the market turbulence over the past two years, not to mention challenges presented by higher construction and financing costs. According to STR, construction activity declined for the seventh straight month in June, with 149,198 rooms under construction. “Once the investment climate gets a little bit better, I think we will see that climbing back up again,” says Wilson. STR is reporting an additional 281,190 rooms in the planning stage.

Some investors have viewed the disruption in the market as an opportunity to acquire assets at a discount to 2019 prices and/or to gain a foothold in desirable markets.

Some developers are pushing forward with new projects. For example, Irvine, Calif.-based Shopoff Realty Investments is developing Dream Las Vegas on a prime 5.25-acre site on the Strip. Shopoff Realty acquired the site in a joint venture with Contour Real Estate just prior to the outbreak of COVID-19 in February 2020. Construction is now underway on the 20-story resort hotel that will include 525 rooms and suites, gaming, dining and nightlife, retail, meeting rooms, pool deck, and a fitness center. Branded and managed by the Dream Hotel Group, the project is set to be completed in fourth quarter of 2024.

“Well-located luxury and resort-oriented hotels were a big winner during COVID. Room rates in resort locations skyrocketed during COVID and they held,” says William Shopoff, CCIM, president and CEO of Shopoff Realty. Although luxury destination resort hotels can get built today, Shopoff admits that the financing market for such deals is incredibly challenging. “With our Dream Las Vegas project, we had to knock on a lot of doors and kiss a lot of frogs to get our capital structure put together. It was not easy,” he says.

Several factors gave Shopoff confidence in moving forward with Dream Las Vegas, including a strong rebound in the city’s visitors and gaming business. “We think that Las Vegas has proved that it is resilient, and it’s going to be a place where we want to do business,” says Shopoff. “People are willing to spend on experience, and that’s what we’re betting on with Dream.” Shopoff also has a site on the California coast in Huntington Beach where it is currently trying to get city approval to build a 215-key hotel. That will be unique because it is coastal California, so it should be a project that is financeable, he says. “Now is not the time to do generic projects, whether it is retail, office, or hotels,” he adds.

Other commercial real estate professionals continue to see pockets of opportunity for new development in metros across the country. In Indianapolis, opportunities are available in growing suburban markets with good interstate accessibility, such as Westfield, Fishers, Zionsville, and Whitestown, notes Lady. Some developers also are finding success with newly built downtown projects. For example, the developer of a 2021-built TownePlace Suites on South Meridian Street in downtown Indianapolis was projecting 58 percent occupancy for the 146-room hotel in the first year and 70 percent in the second year. The developer is confident that the property will meet, if not exceed, those pro forma levels, and they also are seeing strong interest from prospective buyers, says Lady.

Headwinds Gather

High construction costs and rising interest rates are creating near-term challenges for both investors and developers. For example, Marse has a listing on the Loew’s State Theatre on Canal Street in New Orleans that is entitled for a 200-room hotel to be constructed on top of the historic theater. Although it is a trophy asset in a great location, higher construction costs and rising interest rates have slimmed the buyer pool for that asset, notes Marse. “I think we are going to see less speculative builds and less construction overall, and more people that are looking for turnkey assets,” he says.

Similar to what’s happening in retail, some buyers also are looking to create more experience-based hotels, notes Marse. For example, Angevin & Co. and GBX Group acquired the Whitney Hotel in New Orleans earlier this year. The historic hotel located in the central business district that had been shut down for a few years. The new owners are planning a major renovation that includes adding a new restaurant and bar, with the reopening planned for first quarter 2023.

Older hotels that can be purchased in the range of $70,000-$80,000 per key are very popular right now, agrees Wason. One of the major drivers for demand has been the skyrocketing construction costs, which now range from $175,000 to $300,000 per key. Because of those high building costs, investors are going in and buying existing properties at lower cost and putting in another $10,000-20,000 per room to get a practically new property, he says.

Developers also are getting more creative in generating attractive yields. For example, the owner of the Fireside Inn in Auburn, Maine, went in and demolished the existing restaurant and lobby and then partnered with a retail developer who put in a Dunkin’ Donuts and other retail space. The owner then renovated the hotel portion to a dual-branded property as a Quality Inn and Econo Lodge with a shared lobby. “That project was a home run, and I think we’re going to see more dual-branded conversions in the future,” says Wason. The same developer took an existing hotel that he purchased for $3.2 million and dual-branded it as a Quality Inn and a Roadway. Wason Associates recently brokered a purchase agreement for the property at $6.5 million.

Over the next 10 years, Wason predicts that one of the biggest trends is likely to be redevelopment of older hotels that are in the best locations. “There is going to be a point where the land value is going to exceed the value of the property’s income stream,” he says.

One question is whether concerns about a recession could put a damper on the hotel market recovery. “There does not appear to be any local slowing due to recessionary fears,” says Lady. However, historically, there has been a high correlation between the S&P 500 and RevPAR on a one-quarter lag. So, if that indicator holds up, there could be some future declines in RevPAR because the S&P 500 is down approximately 15 percent year to date as of early August, notes Lady. Increases in gas prices is another headwind as it could slow travel, especially for some of the drive-to destinations, he adds.

Signals are mixed on whether the economy might be headed for a recession, or perhaps is already in a recession. Certainly, the overall economy does play a role in performance of the hotel sector, as well as how quickly demand from the business traveler comes back, says Wilson. “I think it’s important to underscore how impressive the resiliency of the hospitality industry is,” he says. “The fact that it bounced back and there is such an appetite to travel, particularly on the leisure side, really bodes well for the outlook of the industry.”