Health, Hospitality, and Home

The seniors housing market is a unique niche of multifamily that can be a bit more complex than an average apartment building. In many ways, it’s a hybrid of real estate, health care, and hospitality. When it comes to real estate, that’s what we know — that’s part of the equation that shouldn’t be a problem. But add the responsibilities of a hotel operator, where you are providing meals, cleaning, and other day-to-day services that residents expect — that’s less familiar. On top of all this, there are significant health care considerations in providing access to doctors, medication, and nursing.

Aging Into Opportunity

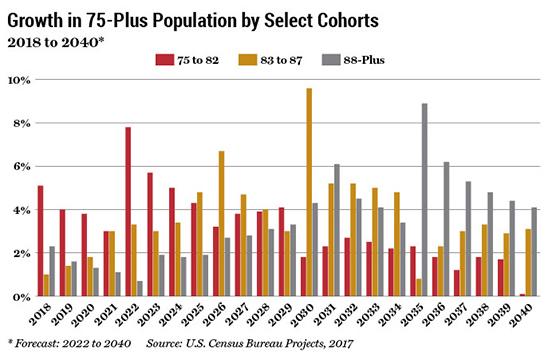

Demographic trends are wind in the sails of seniors housing. The baby boomer generation, meaning those born between 1946 and 1964, represents nearly 25 percent of the total population in the U.S. While the oldest baby boomers are turning 76 this year, roughly 10,000 turn 65 years old each day. Over the next 10 to 12 years, the demand for seniors housing will increase. It’s also important to remember that many decision-makers in these situations are the children of the residents, 35- to 55-year-olds who are involved in the long-term planning for increased care. This factor is important when considering locations for skilled nursing and other health care-intensive offerings. Florida and Arizona are flush with beautiful independent living options, for example, but what happens when more care is necessary? At that point, the children may want their mom or dad closer to home, which could factor into demand in the Midwest and Northeast.

Supply, meanwhile, is in a state of flux. Some older properties are available, though these assets will require investment, and the pandemic limited the amount of properties to reach the market in the last few years. Increasing interest rates will also impact everyone from residents up to the institutional level investor.

Land is very much needed for development as supply hustles to keep up with demand. Generally, seniors housing isn’t at the top of the list when thinking about uses for land. Helping someone find land and go through the development and zoning processes are avenues for commercial real estate professionals to get involved in this market. The expertise in getting projects approved by the necessary parties is very much needed.

Another area that is going to be more relevant in the future is repositioning of old assets, including the adaptive reuse of properties like schools, hotels, and multifamily units that have run through their life cycle. An asset is not being utilized to its highest capacity — or at all — could be an opportunity to list or buy with the possibility of repositioning it as seniors housing.

Knowledge in specific marketplaces is also important. Tracking current inventory and keeping up with market data are two ways to provide added value to clients. Someone with expertise in a specific area can be an important resource. Seniors housing is simultaneously a local and national business, more so than many other areas of commercial real estate. Investors may come from all areas to invest in a local market. Similarly, depending on the project, the CRE expert may be called on to act as the developer or project manager. Smaller groups may not have the experience and skills for development — their expertise is often with caretaking and managing the relationships with tenants. Nonprofits, for example, are active in the seniors housing market.

Range of Services

In a simple sense, as a facility increases its resources related to the health care part of the equation, it decreases hospitality offerings. The property types that welcome younger, healthier populations will focus on amenities and social programs, while facilities handling older, frail people will be occupied with medical treatment and therapies. Across the continuum of care, there are five major property types within the seniors housing sector.

Independent Living: These are facilities with independent residences for seniors, with the operator providing food service, transportation, and social programs. The living spaces are for those individuals who are relatively healthy and mobile — they can still take care of themselves completely on a day-to-day basis. These facilities are more of a want than a need, in that people opt for the support as a lifestyle preference.

Assisted Living: On the continuum of care, these locations are a step up from independent living. In addition to the services offered by independent living, assisted living will provide support for some personal care that includes bathing, dressing, and managing medications. These residents are a little more limited in capabilities, but can maintain some sense of independence.

Memory Care: This category is an extension of assisted living that deals with dementia, Alzheimer’s, and similar conditions. These facilities are often locked down, so residents aren’t able to wander off. These services often closely parallel assisted living, with the addition of security and other considerations.

Skilled Nursing: These locations are what many think of when it comes to nursing homes. Skilled nursing is for long-term health care issues, where operators must focus more on the health needs of residents and less on the hospitality offerings. These facilities also provide post-acute care for short-term residents, like in the case of someone who gets a joint replacement.

Continuing Care Retirement Communities: Finally, these facilities provide a full spectrum of care options listed here. Typically, someone can become a resident in an independent living situation with the expectation that they will gradually progress through the continuum of care as their health deteriorates.

Seniors housing developments can range in living arrangements they offer, from those for an active lifestyle to more care-focused spaces.

Capital Sources

Seniors housing is a societal need as well as a prospective investment opportunity, so financing can come from a range of sources from the federal government to local banks. Each source tends to specialize in a specific area or areas of the market, but options are available when a development might make sense. Here are the major players:

Freddie Mac and Fannie Mae. These loans are directed primarily at independent living, assisted living, and memory care. (If skilled nursing is involved, it has to be a very small portion). Generally, they can reach 75 percent loan-to-value with 10- to 15-year fixed rates. Freddie and Fannie typically deal with operators with five or more facilities and will stick to Class B assets and above.

Housing and Urban Development. HUD will finance nursing care, assisted living, and memory care, with no more than 25 percent independent living. These loans can go to 80 percent LTV with 35-year fixed rates. It can be difficult to work through the 9-to 15-month process, but it’s worth it considering the favorable terms.

Commercial Banks. Debt capital from banks can be applied to all projects including new construction, acquisition financing, and other banking needs. These loans are 65-75 percent LTV with 3-7 years fixed/floating recourse. Commercial banks are great for small to midmarket locations.

Commercial Finance/Mezzanine Lenders. These loans are higher leverage for a higher yield/interest rate that will loan to less-established owners and operators.

Life Insurance Companies. These lower leverage loans focus primarily on high-quality properties and borrowers, with 65 percent LTV and 10- to 15-year fixed rates.

SBA/USDA. The Small Business Administration and USDA are viable options, but you have to know where to find financing.

Keys to Success

Much like the key to real estate is location, location, location, the important lesson to remember for seniors housing is operator, operator, operator. The people running the facility are critical in the success of any investment. Typically, real estate developers will need to partner with an operator who can provide the housing, hospitality, and health care required by the residents. CRE professionals can put together deals, secure financing, and get shovels in the ground, but the complexity of seniors housing often necessitates bringing in someone to run the daily operations.

Helping someone find land and go through the development and zoning processes for seniors housing are avenues for commercial real estate professionals to get involved in this market.

A lot of factors go into successful operators. In addition to meeting the varied needs of residents, they must also be able to control costs while maintaining a level of satisfaction. One of the first questions from someone looking at a location is, “How’s the food?” This is one example where the operator must run a successful commercial kitchen for dozens of people while sticking to a budget.

Additionally, operators are the ones collecting revenue from Medicare, Medicaid, private insurance, and private payors. A revenue stream from the federal government can be a great source of income, but until it’s up and running, the difficulties involved in procuring payment in a complete and timely manner are many.

The business is complex, but the potential is attractive. The margins of the business change depending on how much care is provided. Independent living and assisted living have margins somewhere between 25-30 percent because they don’t provide as much health care as a nursing home, while skilled nursing facilities hover around 12 percent as an average.

For CRE professionals, plenty of opportunities are available to get involved in seniors housing. Whether as a direct investor in a partnership or as a CRE expert in consulting with larger operators, seniors housing is a growing submarket of the robust multifamily sector.

This article was based on CCIM Institute’s course, “Senior Housing: Fundamentals and Benchmarks,” which is available in an online format. Click here for more information.

Richard Lynn

Seniors Housing Specialist with RML Capital LLC. Contact him at rick@rmlcapital.com.