The Superstar of the Future?

By Ermengarde Jabir, Ph.D. | Summer 2022

While a vast array of properties provide space for health care services —including seniors housing and hospital facilities — medical office buildings are a leading type of property in what is an emerging specialty sector, attracting ever-increasing interest from both developers and investors. Whether purpose-built or adapted to an existing space, medical office space is a hot commodity — with demand in the U.S. being driven by an aging population whose health care needs improve from having providers who are more locally accessible.

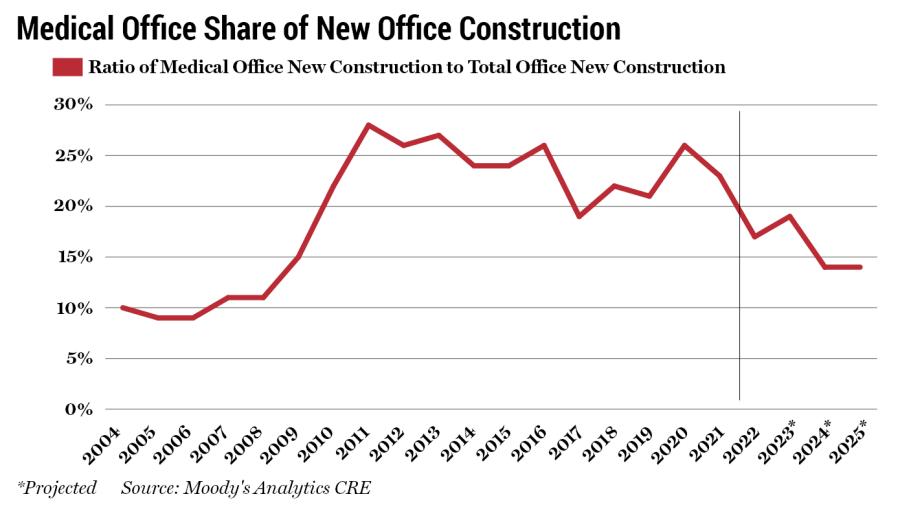

As with so many other commercial real estate sectors, the pandemic rapidly accelerated shifts in medical office space that were already underway long before COVID-19’s arrival. The share of new construction in the office sector dedicated to the medical office subsector illustrates this point. Between 2004 to 2008, the ratio oscillated around 10 percent. With the onset of the financial crisis, demand for traditional office space fell as companies reassessed both their space needs as well as the size of their workforce in the face of global economic distress. At the same time, the first wave of baby boomers was on the cusp of retirement, nearing the age at which the demand for health care traditionally skyrockets. Developers subsequently pivoted to meet shifting demand, with the share of medical office new construction jumping to approximately 15 percent in 2009.

Since 2010, this metric has varied between approximately 20-28 percent. As the second largest generation of adults (only about 1.5 million people fewer than millennials) has continued to age, the share of medical office completions has grown. Even though this share dwindled a bit in the late 2010s, the pandemic ratcheted up the need for ample medical office space once again, and the share has ticked upward slightly in the past two years. While the pipeline for new medical office space remains robust over the coming years, as of now, the share is expected to settle at around 15 percent over the next few years.

The transaction volume of medical office space reveals a similar trend where trading of existing properties began to pick up through the first decade of the 21st century and has continued since then. According to data from the Mortgage Bankers Association, origination volume for health care assets is up 81 percent in the first quarter of 2022 year over year. For comparison, the same metric had increased 41 percent year over year in the first quarter of 2019. Additionally, medical offices tenants are choosing with increasing frequency to tailor existing retail space that is in a prime central location or benefits from other amenities like ample parking to meet their needs. In this manner, retail properties that, for whatever reason, are not attracting the traditional tenant base can pivot to the ever-expanding medical office sector to keep properties occupied. Signing leases with this growing tenant base affords landlords cash flow stability and more predictable revenue because office space that caters to the medical field tends to attract stable tenants as well as a steady patient base — meaning tenants have the means to pay.

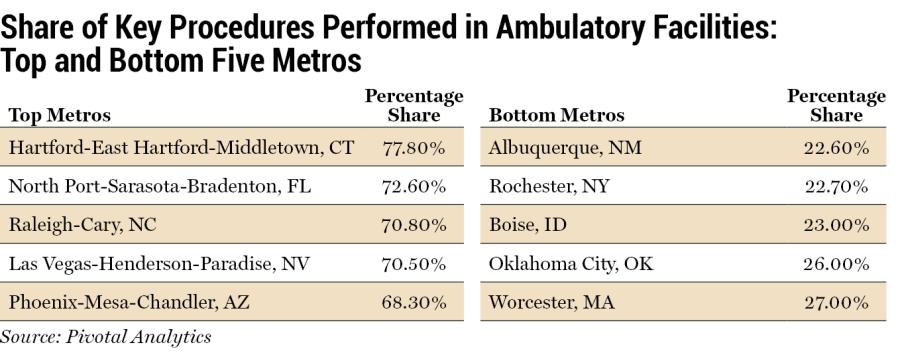

Data from Pivotal Analytics provides insight into the saturation of medical office space in certain markets. (The saturation rate is the total percentage of key procedures performed in ambulatory facilities, which consists of outpatient procedures only.) The table shown above right presents the top and bottom five markets by saturation. Interestingly, areas historically attractive to older demographics, such as Las Vegas, Phoenix, and Sarasota, Fla., have an established presence of medical office space. On the other hand, some of the bottom five metros across the Sunbelt (including Albuquerque, N.M., and Oklahoma City) and the Pacific Northwest (Boise, Idaho) present an opportunity for expansion as they are growth cities attracting corporate relocations and talent.