Worldview: Singapore

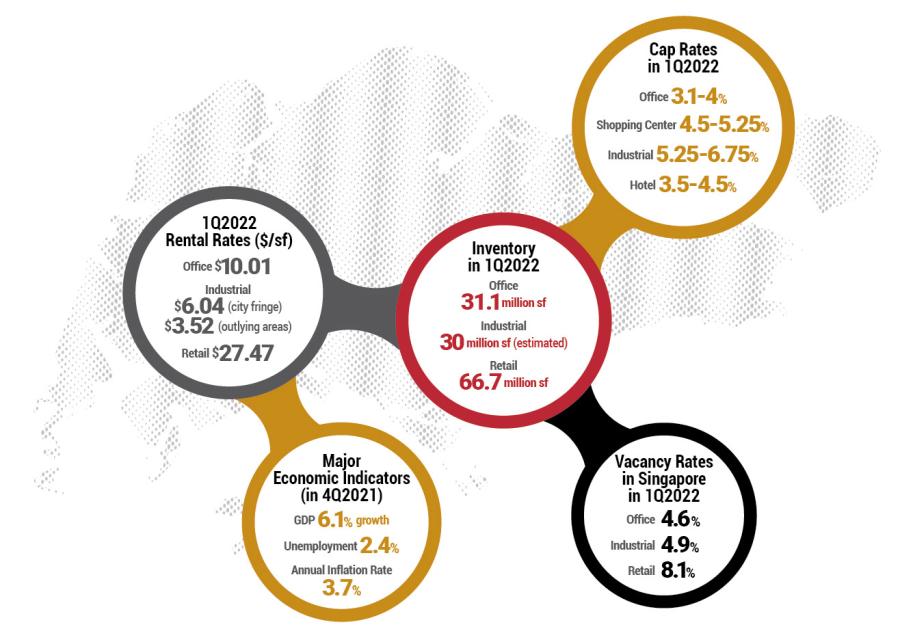

As expected, Singapore bounced back in a major way in 2021, with the economy expanding by 7.6 percent year over year, outpacing initial projections of 7.2 percent. Retail sales surged by 10.8 percent year over year in 2021, though they remained 5.1 percent short of pre-COVID-19 levels. Manufacturing expanded by 13.2 percent, while the office sector slowly began its recovery with vacancy rates beginning to drop, while rents grew by 1.1 percent in downtown areas and 0.7 percent in suburban locations.

“Investment sales momentum is expected to stay robust this year amid stable economic growth and the gradual resumption of various economic activities. Investment sales volumes could surge in the upcoming quarter as various mega deals are expected to be completed by then,” writes Xian Yang Wong, head of research in Singapore for Cushman & Wakefield.

Looking forward to the rest of 2022 and 2023, Wong outlines an improving situation across the primary CRE markets:

- Stable economic growth could boost investors’ confidence in acquiring quality commercial assets despite risks like rising interest rates and inflation.

- Private residential investment sales will continue to increase.

- Hospitality deals could tick upward as tourism recovers as border restrictions are relaxed.

- The investment sale market may grow in 2022 amid the completion of large commercial deals.

While many in the CRE markets look at the future with cautious optimism, reasons for concern are visible. The ongoing geopolitical crisis related to the Russian invasion of Ukraine could threaten global supply chains and food production. Inflation, tied directly to increasing energy prices and otherwise, represents another challenge that could darken Singapore’s economic outlook. Also, COVID-19 still threatens to disrupt the regional and global economy as surges in cases may result in lockdowns across the globe.

Data provided by Cushman & Wakefield and CBRE.